Social Hub TaxWill

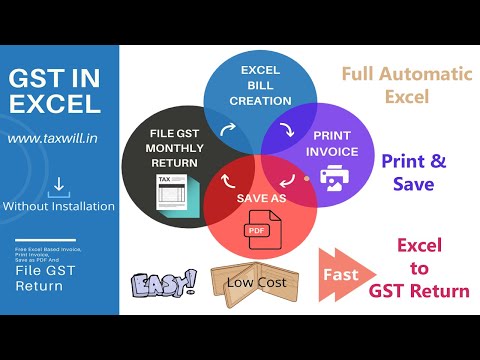

Fully Automated Excel Invoice Software to Create, Save and File GST ReturnFebruary 22Created by TAXWILL EXCEL BASES ACCOUNTING SOFTWARE Fully Automated Excel Invoice Software to Create, Save and File GST Return in Excel GST Excel sheet formula software free download Gst excel bill format gst excel billing software free download excel gst billing software gst offline tool excel to json accounting,gst bill,Save and File GST Return in Excel,excel accounting software,excel accounting software with gst free download,free excel accounting software,excel based accounting software,excel billing software,free excel billing software,excel billing system,excel billing jobs,excel me billing kaise karte hain,excel billing login,excel billing number,excel billing not working,excel billing questions,excel billing question and answer

Excel fully Automatic bill create, Print, Save in excel and PDF. better then tallyMay 21Excel fully Automatic bill printing, Print, Save in excel and PDF. https://www.taxwill.in/2020/05/free-excel-based-invoice-bill-print.html?m=1 To contact us Mail taxwill4u@gmail.com Gst Return Filing Gst Registration Process In Hindi Movie How To File Gst Return In Excel Better Then Tally Helfull for Monthly GST return filling and Annual return Appoint online Accountant thank you

Free Excel accounting software, save and earn money, safe, easy and freeDecember 1Income tax return, GST, company registration, FSSAI, Trademark, MSME, Import Export code, ROC filling, CA, CS, Advocate services etc. Visit www.taxwill.in Free ebooks for CA, LLB students Study.taxwil.in

GST bill save in excel fully automatic.February 26Share, Subscribe and mention email id in comment box if you want to maintain debtor, creditor, stock, balance sheet in excel please subscribe my channel (mai aasi video or la kar aaunga)

Residential status of India part 1May 201. Meaning and importance of residential status The taxability of an individual in India depends upon his residential status in India for any particular financial year. The term residential status has been coined under the income tax laws of India and must not be confused with an individual’s citizenship in India. An individual may be a citizen of India but may end up being a non-resident for a particular year. Similarly, a foreign citizen may end up being a resident of India for income tax purposes for a particular year. Also to note that the residential status of different types of persons viz an individual, a firm, a company etc is determined differently. In this article, we have discussed about how the residential status of an individual taxpayer can be determined for any particular financial year 2. How to determine residential status? For the purpose of income tax in India, the income tax laws in India classifies taxable persons as: a. A resident b. A resident not ordinarily resident (RNOR) c. A non-resident (NR) The taxability differs for each of the above categories of taxpayers. Before we get into taxability, let us first understand how a taxpayer becomes a resident, an RNOR or an NR. Resident A taxpayer would qualify as a resident of India if he satisfies one of the following 2 conditions : 1. Stay in India for a year is 182 days or more or 2. Stay in India for the immediately 4 preceding years is 365 days or more and 60 days or more in the relevant financial year In the event an individual who is a citizen of India or person of Indian origin leaves India for employment during an FY, he will qualify as a resident of India only if he stays in India for 182 days or more. Such individuals are allowed a longer time greater than 60 days and less than 182 days to stay in India. However, from the financial year 2020-21, the period is reduced to 120 days or more for such an individual whose total income (other than foreign sources) exceeds Rs 15 lakh. In another significant amendment from FY 2020-21, an individual who is a citizen of India who is not liable to tax in any other country will be deemed to be a resident in India. The condition for deemed residential status applies only if the total income (other than foreign sources) exceeds Rs 15 lakh and nil tax liability in other countries or territories by reason of his domicile or residence or any other criteria of similar nature. Resident Not Ordinarily Resident If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions: 1. Has been a resident of India in at least 2 out of 10 years immediately previous years and 2. Has stayed in India for at least 730 days in 7 immediately preceding years Therefore, if any individual fails to satisfy even one of the above conditions, he would be an RNOR. From FY 2020-21, a citizen of India or a person of Indian origin who leaves India for employment outside India during the year will be a resident and ordinarily resident if he stays in India for an aggregate period of 182 days or more. However, this condition will apply only if his total income (other than foreign sources) exceeds Rs 15 lakh. Also, a citizen of India who is deemed to be a resident in India (w.e.f FY 2020-21) will be a resident and ordinarily resident in India. NOTE: Income from foreign sources means income which accrues or arises outside India (except income derived from a business controlled in India or profession set up in India). Non-resident An individual satisfying neither of the conditions stated in (a) or (b) above would be an NR for the year. 3. Taxability Resident: A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India. NR and RNOR: Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice.

Computation of income taxMay 23computation of income tax computation of income tax of individual computation of income tax on salary computation of income tax of company computation of income tax for the financial year 2019-20 computation of income tax payable computation of taxable income computation of taxable income from salary computation of taxable income from house property computation of taxable income from other sources computation of taxable income under salary head computation of taxable income from business or profession

Gst Portal data match with books in fully automatic excel.June 14Gst Portal data match with books in fully automatic excel.

Full automatic Excel for school and Excel for AccountingJuly 24To Buy customize Excel Software. Contact us on 8700745227 ✔️Free online classes. ✔️Free study material & Commerce Classes www.Study.taxwill.in #taxwill ✔️Download our brand new Mobile Application for free content - https://play.google.com/store/apps/de... ✔️To Buy Our Complete Video Classes Visit - https://study.taxwill.in ✔️ Facebook – https://www.facebook.com/taxwill4u/ ✔️Other courses: https://study.taxwill.in/ or call at 8700745227 ⚡ Watch More Recent Important Videos ⚡ ✅FREE Excel GST Billing software - https://www.youtube.com/watch?v=yLFUc... ✅Measure of central Tendency part-1-https://youtu.be/Ps1GTUPemCk ✅Measure of central Tendency (introduction)-https://youtu.be/HnIqsjWfFQo ✅Measure of Correlation(part-2)https://youtu.be/-Ly6uXFc198 ✅Measure of Correlation(part-1)-https://youtu.be/Ja31o9jGPac ✅Measure of dispersion Part-3-https://youtu.be/fiKRuxnCnDg ✅Measure of dispersion Part-2-https://youtu.be/QMPah1tLdJ4 ✅Measure of central Tendency-https://youtu.be/VkuDPq4wkJ0 ✅Presentation of data part-2-https://youtu.be/w0er_8Ohwio ✅Presentation of data part-1 - https://youtu.be/XG1cblHNI68 ✅Presentation of data overview-https://youtu.be/JNtVf_kzvL8 ✅Data Collection- https://youtu.be/L9Kzg2rQH0s ✅ECONOMICS REFORM PART-1- https://youtu.be/wEgPvuZxPCo ✅ECONOMICS REFORM PART-2- https://youtu.be/T1UKOy22XFM ✅Introduction of economics - https://youtu.be/ZNXzkJDBpI4 ✅Residential Status - https://youtu.be/3P1-rCcACjY ✅FREE Excel GST Billing software - https://www.youtube.com/watch?v=yLFUc...

GST Bill Invoice and Format, Fully automatic invoice.July 26To Buy customize Excel Software. Contact us on 8700745227 ✔️Free online classes. ✔️Free study material & Commerce Classes www.Study.taxwill.in #taxwill ✔️Download our brand new Mobile Application for free content - https://play.google.com/store/apps/de... ✔️To Buy Our Complete Video Classes Visit - https://study.taxwill.in ✔️ Facebook – https://www.facebook.com/taxwill4u/ ✔️Other courses: https://study.taxwill.in/ or call at 8700745227 ⚡ Watch More Recent Important Videos ⚡ ✅FREE Excel GST Billing software - https://www.youtube.com/watch?v=yLFUc... ✅Measure of central Tendency part-1-https://youtu.be/Ps1GTUPemCk ✅Measure of central Tendency (introduction)-https://youtu.be/HnIqsjWfFQo ✅Measure of Correlation(part-2)https://youtu.be/-Ly6uXFc198 ✅Measure of Correlation(part-1)-https://youtu.be/Ja31o9jGPac ✅Measure of dispersion Part-3-https://youtu.be/fiKRuxnCnDg ✅Measure of dispersion Part-2-https://youtu.be/QMPah1tLdJ4 ✅Measure of central Tendency-https://youtu.be/VkuDPq4wkJ0 ✅Presentation of data part-2-https://youtu.be/w0er_8Ohwio ✅Presentation of data part-1 - https://youtu.be/XG1cblHNI68 ✅Presentation of data overview-https://youtu.be/JNtVf_kzvL8 ✅Data Collection- https://youtu.be/L9Kzg2rQH0s ✅ECONOMICS REFORM PART-1- https://youtu.be/wEgPvuZxPCo ✅ECONOMICS REFORM PART-2- https://youtu.be/T1UKOy22XFM ✅Introduction of economics - https://youtu.be/ZNXzkJDBpI4 ✅Residential Status - https://youtu.be/3P1-rCcACjY ✅FREE Excel GST Billing software - https://www.youtube.com/watch?v=yLFUc...

Excel based Accounting softwareSeptember 19TO BUY THIS SOFTWARE CALL US ON 9306079131. Following are the Main Features of this excel fully automated excel invoice software 1) Auto-calculation of every entry 2) Calculate automatically GST according Sale type 3) Save PDF of every Invoice 4) Also Saved Editable format of every Bill 5) Seller Billing Details automatically added in New sheet 6) Direct Open any save bill 6) Create Items Direct 7) Create Party Details 8) create receipt entry 9) check party wise ledger also export in pdf file 10) Check party Due Balance

Fully Automated Excel Invoice Software | GST BILL in Excel | excel software for GST return filingSeptember 22Fully Automated Excel Invoice Software to Create GST BILL in Excel | excel software for GST return filing| GST excel software To Buy Excel software. Call us on 8700745227 For more details, Please visit our website taxwill.in आपके लिए है ये GST Invoice Excel Software, Yes Guys this is fully automated excel Invoice software to create Automatic GST bill there are lots of features including auto calculation, so you must go with this software while making bill in excel you should use this to get your bill PDF file automatically saved in folder. if you don't know How to create invoice in excel? or how to make bill in excel or how to make GST bill in excel? all these questions get solved after watching this video. #ExcelInvoice #ExcelBill #ExcelGSTInvoice Fully Automated Excel Invoice to Create GST bill in Excel, How to make bill in excel, how to make gst bill in excel, make gst invoice in excel, automatic bill in excel, automatic gst invoice in excel, excel gst invoice software, excel gst bill, create bill in excel, create gst bill in excel, excel billing software, make bill in excel, invoice, bill, gst bill, excel bill, free excel billing software, excel

Professional & Smart Workers Working, Most Satisfying Factory Machines & Ingenious Tools #1May 2Professional & Smart Workers Working, Most Satisfying Factory Machines & Ingenious Tools #1 If You like Video, Don't Forget Like , Comment And Subscribe My Channel. --------------------------------------------------------------------------------------------------------------

0 Comments