- Home

- TAX

- _ITR

- _GST

- __GST Reg. & Return

- __GST Free Acc Software

- __Zero Balance Current Acc

- _Amzone / Flipcart + GST

- _Trademark Registration

- _MSME Registration

- Website

- _Website & Android App

- _Google / Fb / Insta Ads

- _SEO & SMO

- Income Tax Update

- GST Update

- Contact Us!

- Free Tools

- _Excel Software

- _Password Generator

- _Internet Speed Check

- _Generate QR Code

- _YouTube Tuhmnail

- _Privacy Policy Create

- _Youtube Download

- Career

Showing posts with the label Income taxShow all

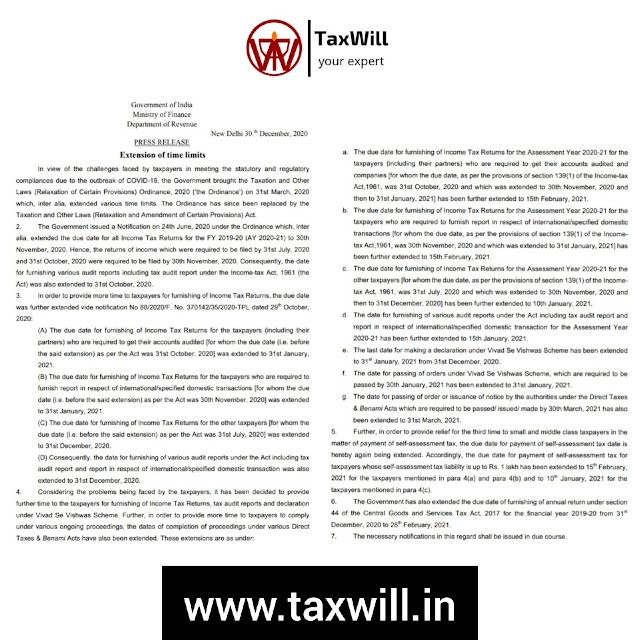

ITR filing 10 day relief due date Dec 31 to January 10, 2021 for FY 2019-20

AI Marketeers

December 30, 2020

Government of India Ministry of Finance Department of Revenue New Delhi 30.th December, 2020 PRESS RELEASE Extension of time limits In view of the challenges faced by taxpayers in meeting…

Income tax calculator | incometaxefiling | income tax return

AI Marketeers

February 01, 2020

Income tax calculator Income tax calculator Free tools INCOME TAX CALCULATOR Please Mention Details Newly proposed income tax slabs: No income tax for those earning less than R…

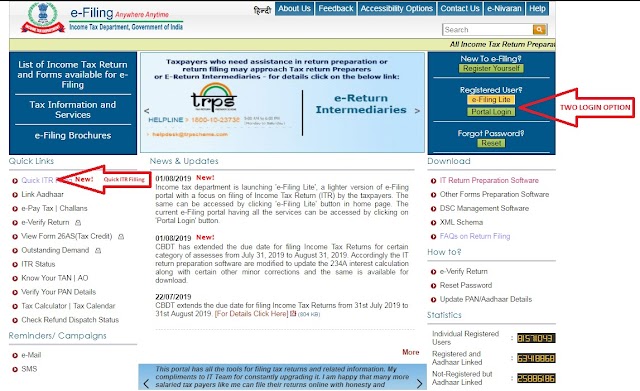

Two changes in income tax website efillng lite and Quick ITR FILE

AI Marketeers

August 01, 2019

NEW DELHI: A 'lite' e-filing facility was launched by the income tax department on Thursday to facilitate easy and quick filing of returns by taxpayers. The facility was operatlionalis…

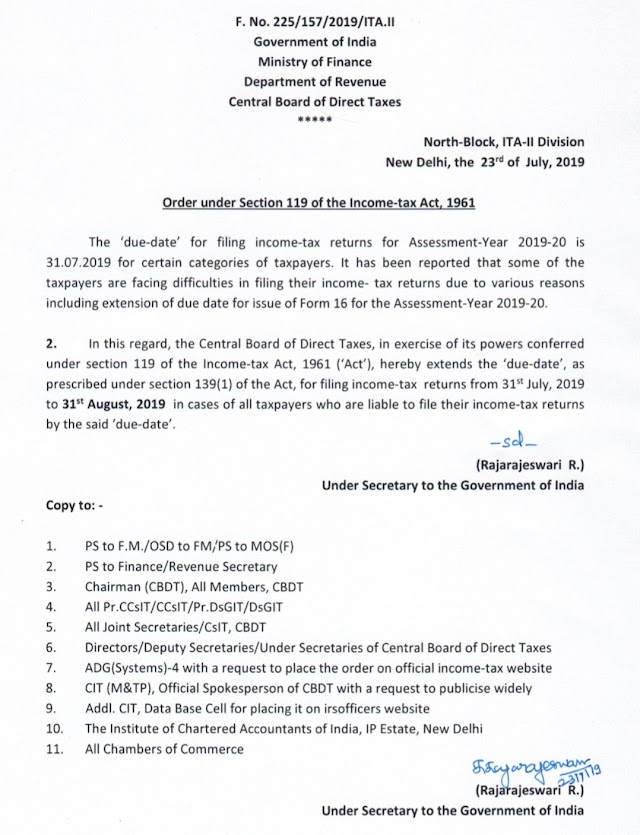

The Central Board of Direct Taxes (CBDT) extends the 'due date' for filing of Income Tax Returns from 31st July, 2019 to 31st August, 2019 in respect of certain categories of taxpayers who were liable to file their Returns by 31.07.2019.

AI Marketeers

July 23, 2019

Order u/s. 119 of the income-tax Act,1961 for extension of due date for filing of ITRs for the A.Y 2019-20 from 31st July, 2019 to 31st August,2019

Income tax slab rate for Fy 2018 -19 or AY 2019 - 20

AI Marketeers

July 06, 2019

Income Tax Slab For FY 2018-19 The finance minister during his budget speech has announced that there will be no change in the structure of the income tax rates for individuals. There is a…

Penalty under section 234F late filling of Income tax return

AI Marketeers

December 25, 2018

Need an Expert Help Click Here Call on 8700745227 From which date the provisions of penalty under section 234F shall be effective?

Misinterpretation of Data on filing of I-T return by CAs by Newspapers: ICAI clarifies

AI Marketeers

October 31, 2018

ICAI has written letter dated 26.10.2018 to the editors of The Pioneer, The Tribune Trust and The Times of India in which it has highlighted the fact that they have misinterpreted the Data on dire…

how to fill form 16 for salary with example

AI Marketeers

October 30, 2018

Contents 1. What is Form 16: 2. Parts of Form 16: a) PAN b) TAN c) Gross salary d) Perquisites e) Profits in lieu of Salary f) Allowances which are part of Form 16 g) Deductions h) Ed…

CBDT extends due date for filing of Income Tax Returns & audit reports from 30th Sept, 2018 to 15th Oct, 2018

AI Marketeers

September 25, 2018

CBDT extends due date for filing of Income Tax Returns & audit reports from 30th Sept, 2018 to 15th Oct, 2018

Tax Deducted at Source (TDS) Rate Chart/Slab for Financial Year (FY) 2017-18 / Assessment Year (AY) 2018-19

AI Marketeers

September 02, 2018

Tax Deducted at Source (TDS) Rate Chart/Slab for Financial Year (FY) 2017-18 / Assessment Year (AY) 2018-19

CBDT has extended the 'due date' for submission of Returns of income from 31/08/2018 to 15/09/2018 in the case of income tax assessees in the State of Kerala,who are liable to file their Income tax returns by 31/08/2018

AI Marketeers

September 01, 2018

The Income Tax Department on Tuesday extended the due date for filing income tax return (ITR) by fifteen days for assessees in Kerala.

Business codes for income tax return forms

AI Marketeers

August 28, 2018

CBDT has changed nature of business codes for income tax return forms from A.Y. 18-19.

Govt extends deadline for filing income tax returns by a month to August 31

AI Marketeers

July 26, 2018

Amit Panwar TaxWill News The Central Board of Direct Taxes (CBDT) has extended the due date for filing of Income Tax Returns to August 31, 2018, for categories of taxpayers who were t…

Clubbing of Income के इन प्रावधानों के बारे में नहीं पता तो हो सकती आपकी इनकम के कैलकुलेशन में गलती।

AI Marketeers

June 16, 2018

Clubbing of Income Under Income Tax Act 'Its all in the family' . It may seem ordinary to invest money for a non earning spouse by way of fixed deposits, or other income earning a…

File Income Tax Return From your Home

AI Marketeers

June 15, 2018

File Income Tax Return From your Home Online Income Tax Return Filing by Experts ITR online filing from anywhere, anytime A distinctive messaging platform to reach the tax exper…

How to choose right Tax Practitioner? Who is complete your all legal requirement?

AI Marketeers

May 30, 2018

How to choose the right tax practitioner ? When using a tax practitioner to file your annual tax return, do not merely go and grab the first one you meet who says he knows how to f…

How salary employee file ITR Free? Or file self return filling Procedure?

AI Marketeers

May 29, 2018

Self Income Tax Return Filling is a very easy process only of Salaried Employee. But It has some Disadvantages: Mistakes in filing income tax returns that may get you a tax notice You have …

Gpay and Clelebrate

Random Posts

3/random/post-list

Popular Posts

All GST HSN code and rates in excel

May 16, 2020

Earn money from home in quarantine

May 17, 2020

Menu Footer Widget

Copyright © 2019 taxwill.in All Right Reserved

Crafted with by TemplatesYard | Distributed by MyBloggerThemes

Social Plugin